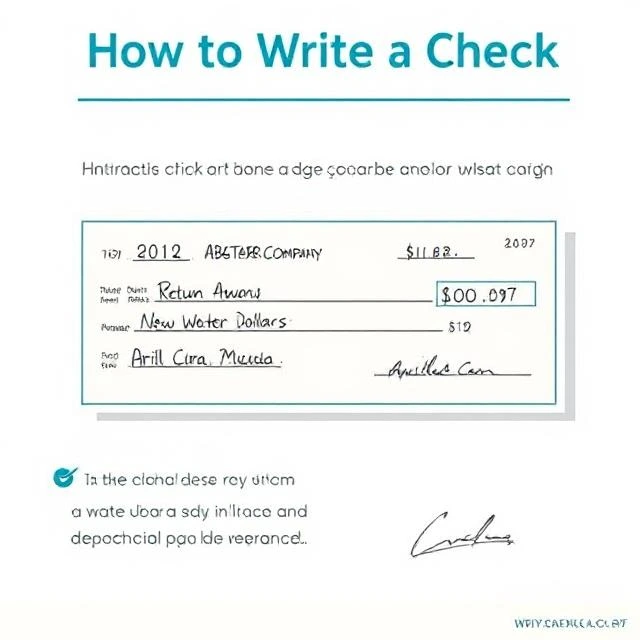

How to Write a Check : Everything You Need to Know

Knowing how to write a check is key for managing your money well. It’s important for paying bills and making payments. This guide will show you how to do it right, making your transactions safe and clear. Understanding the Process of Writing a Check Learning the basics is key to ensure your check is processed right. We’ll cover the main steps with bank check instructions and tips. Every detail is important to avoid delays or rejections. Required Components of a Check Here are the parts you need for a check: Common Mistakes to Avoid Check formatting tips help you avoid common errors: By following these steps, you ensure smooth and secure transactions. Always check your bank’s guidelines for specific bank check instructions. How to Write a Check : Everything You Need to Know, Make Money: Tips for Financial Success Turning check writing into a way to grow your money starts with seeing it as part of money management strategies. By treating every check as a step toward discipline, you build habits for long-term stability. Here’s how to make the most of this simple practice. Leveraging Check Writing for Budgeting Checks aren’t just for bills—they help you see your spending. Try these steps: Improving Financial Literacy Through Check Transactions Handling checks builds core skills. Consider this comparison: Check Habit Financial Literacy Benefit Signing physically Encourages mindfulness of each transaction Recording dates Teaches chronological tracking of cash flow Endorsing checks Clarifies ownership and authorization processes Every check is a lesson in accountability. Mix this with digital budget apps for a blend of old and new money management strategies. Start small: Use checks for one monthly expense and track results. Over time, these actions build habits that turn everyday tasks into pathways for financial confidence. Conclusion Learning How to Write a Checks is key to managing money well. This guide has shown how to avoid mistakes and control finances better. By using checks daily, people can handle their money with confidence. Writing checks helps keep track of spending. It makes it easy to see where money goes. Keeping a record of every check helps stay on track with financial goals. Using checks every day helps improve financial knowledge. It makes transactions clearer and helps make better choices. These habits turn simple tasks into learning moments. Make a habit of writing checks correctly. Double-checking and comparing bank statements helps stay accountable. Look for resources to improve these skills. Every check you write brings you closer to better financial management. FAQ What are the essential components required when writing a check? To write a check, you need to include the date and the payee’s name. Also, write the amount in both numbers and words. Don’t forget to sign it. You can also use the memo line to explain why you’re paying. What are the common mistakes people make when writing checks? People often make mistakes like writing the wrong amount or forgetting to sign. They might also miss the date or the payee’s name. Always double-check your work before giving the check to someone. How can writing checks help with budgeting? Writing checks helps you keep track of your spending. It makes you think more about what you’re buying. This can help you avoid overspending, unlike using credit cards. Is there a way to improve my financial literacy through check transactions? Yes! Writing checks and checking your bank statements can teach you about money. You’ll learn about budgeting, managing cash flow, and tracking expenses. These are all important for being financially smart. What should I do if I make a mistake on a check? If you mess up a check, void it and write a new one. Just write “VOID” across the old check. Keep it or throw it away safely to prevent misuse. How can check writing enhance my financial security? Writing checks helps you control your spending better. It’s a safer way to pay than credit cards. This can help you avoid debt and stay financially healthy in the long run.